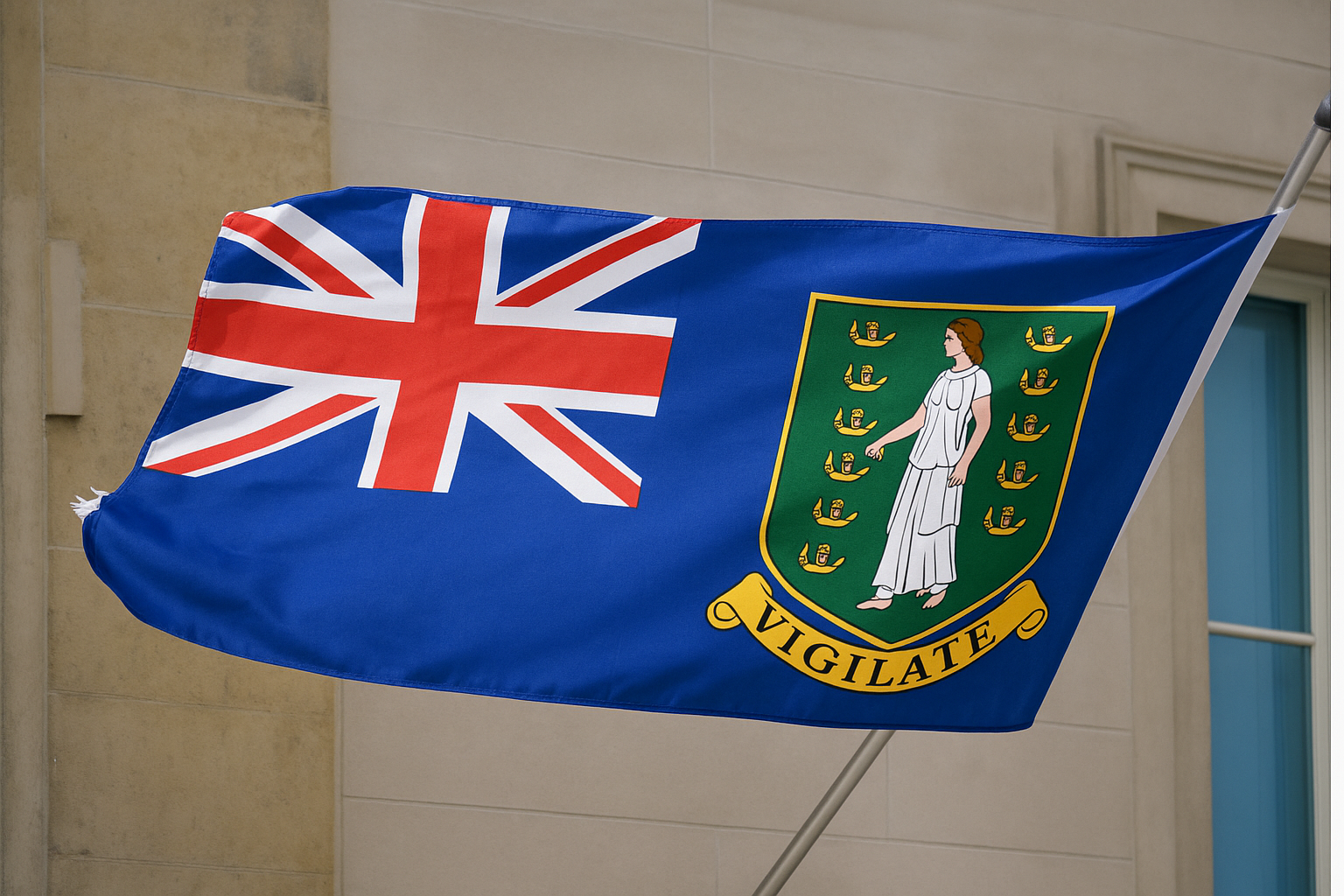

Start a Company in

British Virgin Islands

The British Virgin Islands is the perfect jurisdiction for those seeking favorable conditions for business and maximum confidentiality. Registering a company in the BVI opens up numerous opportunities for international operations with minimal requirements and high levels of information protection.

here's what you need to know

- Company must have at least one director and one shareholder. The company director and/or shareholder can be of any nationality.

- The minimum capital required to incorporate a company is USD 1.

- Business Companies registered in the BVI are not subject to taxation on their worldwide profits.

- BVI companies are required to submit annual financial reports.

- Reporting requirements in the British Virgin Islands are minimal.

Why us?

Responsibility

We take responsibility for our actions and results.

Integrity

We strive to provide the highest level of consulting services

Honesty

We adhere to high ethical standards

Individual approach

Our individual solutions are focused on customer needs

Preparatory stage

- Choose the unique name for your company.

Compile the documents

- Prepare copies of your passport, proof of address for yourself and any directors or shareholders.

- Select your company address or opt to register an address through us.

Submission & Final Approval

- Prepare the Memorandum and Articles of Association

- Submit all the documents to the registrar

Complete the Initial Questionnaire

- Fill out a short form with basic company and contact details

- Indicate your business activity and countries of operation

Choose Your Account Type and Services

- Select between personal, business, or merchant account

- Choose additional services (e.g. multicurrency support, online banking)

Undergo Compliance Check

- Wait for the bank's initial due diligence

- Respond to any additional compliance questions or requests

Account Activation

- Receive final confirmation from the bank

Our solutions include:

- Preparing monthly, quarterly and yearly management accounts, cash flow statements for management purposes.

- Processing payroll

- VAT consultancy, support registration VAT number, filing VAT-returns and reclaiming foreign VAT

- Other financial reports

Streamline administration with our expert help

- Company formation

- Assistance with opening a bank account

- Regulation and licensing

- Legal address & contact person

- Accounting

FAQ

What are the basic requirements for a BVI company?

Each BVI company must have a registered agent and a registered office in the BVI. A minimum of one director is required, with corporate directors allowed. The company must have at least one shareholder. Details of the directors and shareholders must be kept at the office of the registered agent but are not publicly available.

Are there any reporting or compliance requirements for BVI companies?

BVI companies are required to submit Economic Substance Reporting annually, within six months of their financial year-end. There are no requirements for annual returns, annual meetings, or audited accounts.

Is a physical presence required in the BVI to register a company?

No, directors and shareholders do not need to be physically present in the BVI. The entire company registration process can be managed through a registered agent.

Is my information kept confidential?

Yes, the BVI is renowned for its strong confidentiality laws. While some information is maintained by the registered agent, the details of shareholders and directors are not made publicly available.