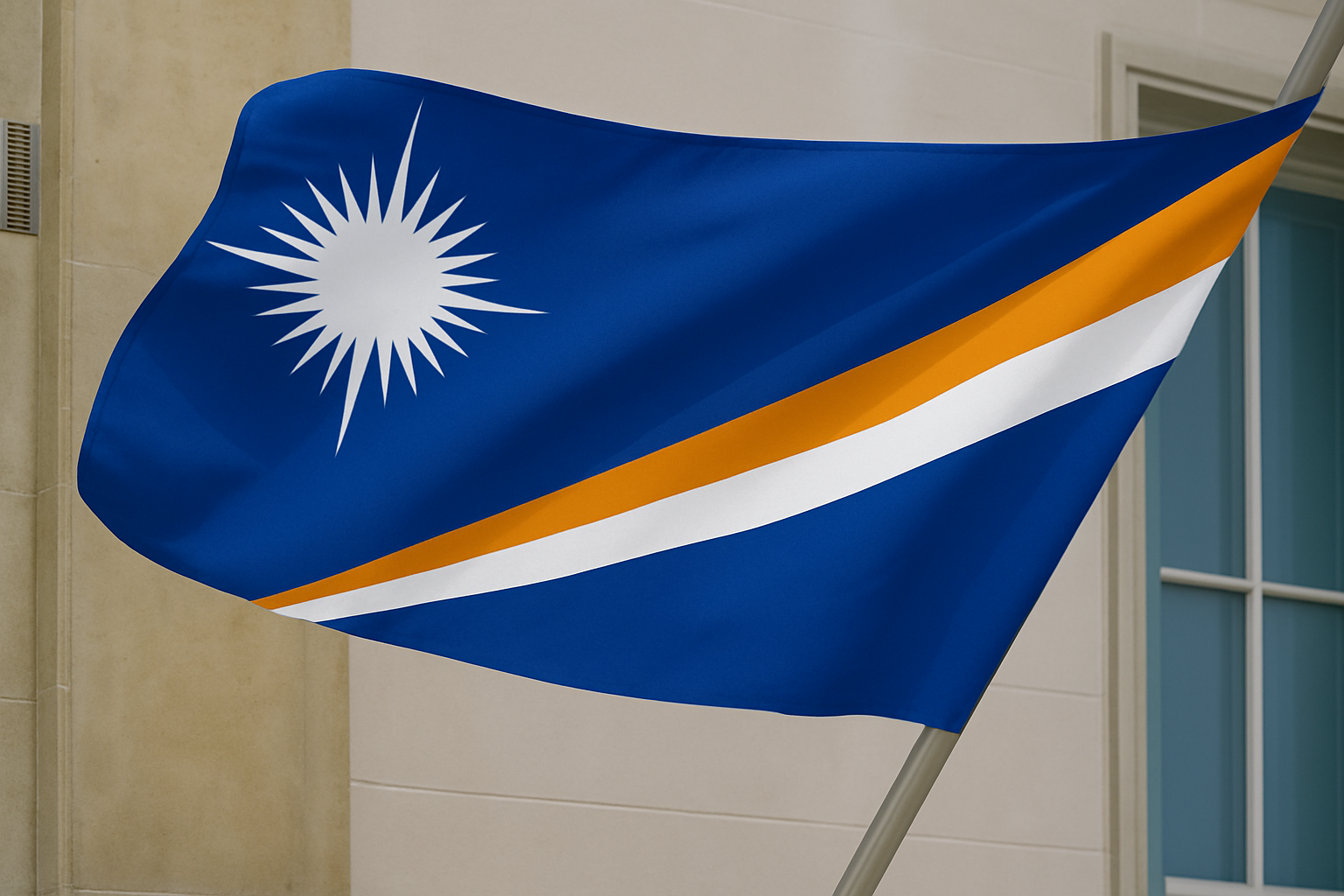

Start a Company in

Marshall Islands

The Marshall Islands offers a business-friendly environment perfect for ventures in intellectual property, asset management, IPOs, and yacht ownership. With no corporate taxes and flexible regulations, it provides an ideal location for companies seeking global expansion and privacy.

here's what you need to know

- No exchange controls on foreign transactions.

- Non-resident entities are exempt from corporate tax, asset tax, and stamp duty.

- Annual tax returns and financial account filings are not required.

- Public records of directors and shareholders are not maintained unless specifically requested.

- No minimum paid up capital

Why us?

Responsibility

We take responsibility for our actions and results.

Integrity

We strive to provide the highest level of consulting services

Accuracy

We adhere to high ethical standards

Individual approach

Our individual solutions are focused on customer needs

Preparatory stage

- Determine the services you will provide.

- Choose the unique name for your company.

Compile the documents

- Prepare copies of your passport, proof of address for yourself and any directors or shareholders, an Authorization Letter, and a 10-second selfie video holding your passport while stating your name, passport number, and the services you have ordered.

Submission & Final Approval

- Once all the necessary documents are collected and prepared we will then submit all documents to the registrar.

Complete the Initial Questionnaire

- Fill out a short form with basic company and contact details

- Indicate your business activity and countries of operation

Choose Your Account Type and Services

- Select between personal, business, or merchant account

- Choose additional services (e.g. multicurrency support, online banking)

Undergo Compliance Check

- Wait for the bank's initial due diligence

- Respond to any additional compliance questions or requests

Our solutions include:

- Preparing monthly, quarterly and yearly management accounts, cash flow statements for management purposes.

- Preparing annual financial statements.

- Attending to the auditors during review of the company’s financial records.

- Administering the payroll process, including calculating and crediting of the net remuneration to individual employee’s bank account.

- VAT consultancy, support registration VAT number, filing VAT-returns and reclaiming foreign VAT

- Other financial reports

Accounting required documents:

- Company bank statements for the accounting reference period.

- Sales orders/invoices.

- List of customer’s deposits and pre-payments outstanding.

- Purchase invoices from suppliers, both paid and unpaid.

- Cash Expense receipts.

- Inventory listing.

- Documents pertaining to purchase, major repair and sales of fixed assets.

- Detailed payroll information.

- Any other related documents i.e. bank loans, lease agreements, insurance.

Streamline administration with our expert help

- Legal address & contact person

- Banking account opening assistance

- Accounting

- Tax consulting

- Company formation

QA

Is it necessary to visit the Marshall Islands for company formation?

Fortunately, you don't need to be physically present in the Marshall Islands to incorporate an offshore company. The entire process can be completed via email within a few working days.

What are the basic requirements for registering a company in the Marshall Islands?

To incorporate an International Business Company (IBC) in the Marshall Islands, you will need: 1. A minimum of one director and one shareholder, who can be the same person. 2. A local registered address in the Marshall Islands with which we can help

How can I open a bank account for my Marshall Islands company?

To open a bank account for a Marshall Islands company, you will need to provide the required identification documents and select a suitable bank. We can assist with this process, including setting up eBanking and credit card facilities through correspondence.

Can foreign nationals register a company in the Marshall Islands, and what are the requirements?

Yes, foreign nationals can register a company in the Marshall Islands without needing to reside there. The main requirements include having a registered agent within the jurisdiction and complying with local regulations for offshore entities. Most foreign nationals choose the International Business Company (IBC) structure for their businesses.